Turkey has struggled to increase its solar capacity in recent years, after China, Vietnam and South Korea, the country plans to become the world’s third largest module maker this year, and has introduced a series of measures to achieve this ambitious goal.

To this end, Sobi Overseas invited Stantec Business Development Manager Celine Ina and Solar Energy Systems Company founder Professor Naras Kavaji to participate in this month’s “Global Photovoltaic Market Overview” theme conference, and have a good understanding of the local manufacturing industry. The current situation and prospects are introduced.

Celine Ina has over 20 years of experience in the renewable energy business including power plant investments (over 2,200 MW of gas, hydro, solar, wind and biogas), power trading, power markets, engineering, investor relations and Project financing; handling projects from a technical, financial, legal and commercial perspective. She first introduced an overview of the Turkish solar market.

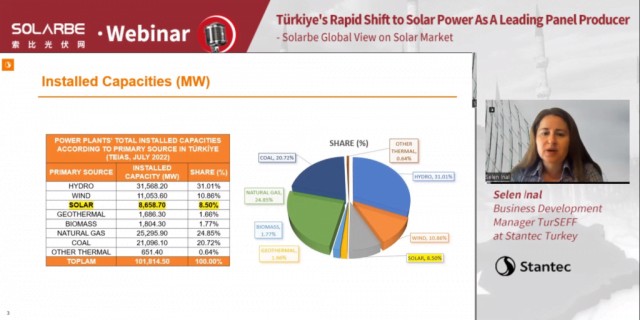

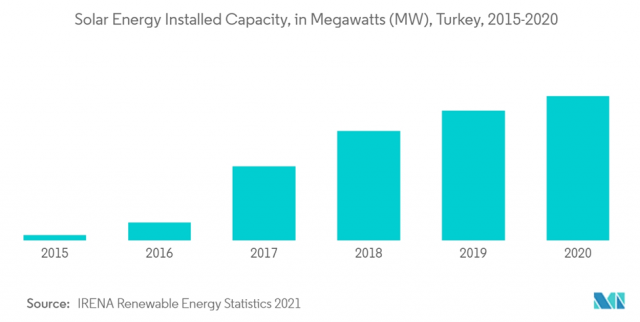

According to Ina, as of July this year, the country had installed 8.7 GW of solar panels, accounting for an 8.5 percent share of the total. Growth in solar installations has also exceeded expectations, a big leap every year from 188 MW in 2013 to 8,659 MW in 2022. Ina said that, given the potential of solar energy and its wide applicability, installations in the region could be further accelerated.

Ina also presented local solar regulations and prices supported by both new and old renewables. Ina said new subsidized prices have been set for solar power plants that will be commissioned between July 1, 2021 and December 21, 2025, which will be based on producer and consumer price indices and exchange rates on a quarterly basis Update once. She added that the new subsidized price will apply for 10 years, and if domestic equipment is used, an additional price will apply for five years.

In response to the development of solar panels, Yina introduced the development and production capacity of local manufacturers. Among them, because of the CW Enerji factory in Antalya and the smart solar factory in Kokali, both provinces have an annual installed capacity of 1GW, which is the province with the highest installed solar panel capacity.

According to her introduction, there are currently about 16 companies on the market that have increased the production capacity of photovoltaic panels to 5.6GW per year in the first half of 2020, plus additional capacity, as well as other small businesses and new entrants, up to 8GW per year. Current cell capacity is estimated at 1.13GW per year, 500MW for wafers and 500MW for ingots.

In terms of local content materials used in photovoltaic panel production, the average panel local content ratio may reach 58.2% (2020). The Turkish government supports and encourages local production of solar panels and uses domestically produced panels in accordance with regulations. At the same time, they have been working to increase export rates in their target foreign markets, which are around 27.5% in the Middle East, 19.6% in Europe and 15.7% in North Africa.

Prof. Nawras Kahwaji, general manager and founder of Solar Energy Systems Company, mainly talked about the strong support of the Turkish government for the local photovoltaic manufacturing industry, as well as the government’s active photovoltaic development policy.

He said that the Turkish government encourages the localization of various industries in the country, including the photovoltaic industry. “The government requires renewable energy developers to purchase equipment and services locally, and requires project developers to purchase nearly three-quarters of equipment and services locally,” he said. The move is intended to improve Turkey’s ability to be self-sufficient in various fields while creating jobs.

According to the Turkish Ministry of Energy, Turkey is currently the fourth largest producer of PV modules in the world, with an annual capacity of 7.96 GW, after China (124 GW), Vietnam (14 GW) and South Korea (9.2 GW). Energy and Natural Resources Minister Fatih Donmez said the country aims to be in the top three globally by 2023.

Turkey has the world’s first and only vertically integrated factory for wafer, cell and module manufacturing in the same facility. Owned by Kalyon Holding, the plant has an initial capacity of 500 MW and is targeting an increase to 1 GW.

Prof Kahwaji added, “Antalya and Kokaeli provinces, with their CW Enerji plant and Smart Solar plant respectively, are the provinces with the highest PV manufacturing capacity, with an annual capacity of 1 GW each.”

At the same time, Turkey is also one of the world’s leading countries in terms of installed wind and solar power, ranking ninth in the world and third in Europe.

The country has the seventh largest photovoltaic power plant in the world and the largest in Europe, the Kalapuna photovoltaic power plant. The power station consists of 1.35 GW of components, which will be converted into 1 GW of alternating current.

Currently, Turkey has a cumulative installed PV capacity of 8.3 GW, with the goal of reaching 30 GW by 2030. The average sunshine duration in Turkey is 7.5 hours, and the potential of rooftop PV is estimated at 20 GW.

In order to attract more investment and help small and medium investors enter the market, the Turkish government released 74 projects with an installed capacity of 10, 15, and 20 MW in 36 regions in October 2021. After the projects are completed, they will supply electricity to 2 million people.

When asked if there is an opportunity for non-Turkish-manufactured modules to enter the country’s market, Prof Kavaji said, “There are foreign brands in the Turkish market, but the Turkish government has changed the way it calculates import duties on PV modules. According to previous, PV modules are taxed by area rather than weight, which is beneficial for imported modules. The government revised the import tax rules in April 2020 to pay tax by module weight, which is significant because imports use new High-efficiency components of the technology are generally heavier, which is good for local manufacturing in Turkey.”

For other components of the PV system, Professor Kahwaji said that there is a manufacturer in Turkey that makes grid inverters, but this is not enough to satisfy the local market. However, for products such as tracking brackets, energy storage, and energy storage controllers, Turkey has local manufacturers covering the local market.