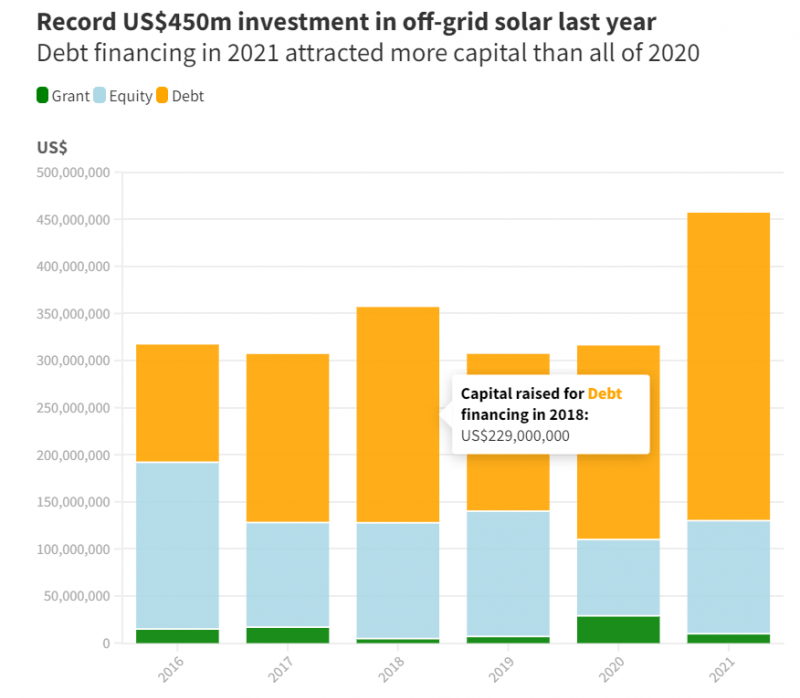

According to the latest report from the Global Off-Grid Lighting Association (GOGLA), investment in the off-grid solar industry hit a record $450 million in 2021.

The industry has seen recovering growth post-pandemic. After hitting the $300 million mark, investment surged by more than 40%.

Despite record investment in 2021, companies in the early stages of development are most affected by the outbreak and have more difficulty attracting equity capital, the report shows.

Debt funding raised in 2021 grew by $326 million, exceeding the investment amount of all capital raised in 2020, driven largely by large debt deals guaranteed by the big operators in the space.

According to GOGLA, debt financing for off-grid projects will reach $326 million in 2021, surpassing all types of financing in 2020

The “big seven” mentioned in the report, including companies such as d.light and Sun King, attracted more capital this year. These operators have secured debt financing for the development of mature off-grid solar markets such as Kenya.

The report argues that climate-focused investors have been keen to enter the off-grid market, given its alignment with investment strategies. In particular, the report noted that Sun King had raised $260 million in equity earlier this year.

Laura Fortes, senior program manager at GOGLA, said, “The record investment in 2021 is a major success for the industry, which gives reason for optimism. It shows the resilience of the industry and the confidence of investors. secured.”

Startups Negatively Affected by the Pandemic

Debt investment in startups nearly doubled year-over-year to $52 million, though it has not returned to pre-pandemic levels. In 2019 and 2018, debt offered to startups approached the $80 million mark.

Grant financing to startups also fell by more than half last year, to $9.1 million from an all-time high of $24 million in 2020.

About three-quarters of venture construction funding is concentrated in early-stage companies, and about half goes to local businesses in this area.

Meanwhile, some short-term concerns have arisen in the investment community as about 25% of companies have announced that their off-grid portfolios are underperforming in 2021, up from 15% last year.

However, more than 70% of respondents said the underperformance appeared to be short-lived and that financial results for the year were expected to be in line with expectations.