The International Energy Agency’s Photovoltaic Power Systems Program (IEA PVPS) recently released a report titled “Trends in Photovoltaic System Applications 2022.” Prices of polysilicon, silicon wafers, photovoltaic cells and photovoltaic modules have all risen in recent years, while China and other countries and regions are also expanding production capacity for photovoltaic products, the report noted.

The report pointed out that prices in the upstream industry of the global photovoltaic industry have risen, mainly driven by high polysilicon prices. Other factors include high silver and aluminum prices, increased logistics costs and semiconductor shortages. China is still the largest producer in the global PV supply chain, but Malaysia, Vietnam, Germany, the United States, India, Norway, Turkey and other countries have also gained a place in the global PV module market.

“I think by the end of this year, global polysilicon production capacity will double from last year,” said Izumi Kaizuka, chief analyst at research firm RTS. “I believe that polysilicon prices will stabilize by the end of next year.”

According to the survey report, by the end of July 2022, the spot price of polysilicon will be US$0.38/kg, up from US$0.29/kg at the end of May 2021 and US$0.10/kg at the end of December 2020.

“In 2022, polysilicon prices will remain high due to growing demand for photovoltaic modules and power shortages that have shut down production at several production plants,” the report said.

The global photovoltaic industry used 604,812 tons of polysilicon in 2021, a significant increase from 497,300 tons in 2020. China is the world’s largest polysilicon producer, producing 623,000 tons in 2021, followed by Germany (65,000 tons) and Malaysia (3,000 tons). Other countries are entering this market or regaining market share.

“Norway has started polysilicon production and Turkey has the production capacity,” Kaizuka said. “I also expect India to increase production, but it will take 2 to 3 years. In the US, some polysilicon manufacturing plants have ceased operations, such as REC Silicon’s Moses. Lake plant, but now they have announced that they will restart polysilicon production. The US production capacity is expected to increase, so its polysilicon production may be more active in the near future.”

The International Energy Agency’s Photovoltaic Power Systems Project (IEA PVPS) expects that China will remain the world’s largest polysilicon producer for now, but future production locations may change due to U.S. restrictions on its imports, which are also expected to promote the increase of polysilicon production in the US photovoltaic industry. “

- The size of silicon wafers is developing in a larger direction

Global wafer production will reach 233GW in 2021, a 39% increase compared to 2020, and global wafer production capacity will be 415GW/year, up from 218GW/year in 2020. Due to the demand for higher efficiency photovoltaic modules, the production and production capacity of polycrystalline silicon wafers decreased, while the production and production capacity of monocrystalline silicon wafers increased.

According to the report, the spot price of silicon wafers generally follows the price fluctuations of polysilicon, and as of the end of July 2022, the spot price of 158.75mm to 161.75mm silicon wafers was US$0.78/piece, up from US$0.74/piece in November 2021 and $0.35/piece in January 2021. Larger 188mm wafers are priced at $0.97/piece.

In the past year, wafer sizes have moved in a larger direction – the market share of 182mm (M10) to 210mm (M12) wafers has increased from 4.5% in 2020 to 45% in 2021, while 158.75mm Wafers up to 166mm account for about 50% of total production.

The International Energy Agency’s Photovoltaic Power Systems Project (IEA PVPS) expects the market share of large-scale silicon wafers to increase further by 2030 and will become the main product.

China produces more than 97% of the world’s silicon wafers and exports about 22.6GW of silicon wafers to other photovoltaic cell manufacturing countries and regions such as Malaysia, Vietnam, Thailand, South Korea and India. Malaysia, Vietnam, Thailand, South Korea and Norway already have the capacity to manufacture silicon wafers, and Hungary, France, Russia, Turkey and Spain have also reported plans to increase production capacity.

- Production of photovoltaic cells

The global production of crystalline silicon photovoltaic cells and thin-film photovoltaic cells will reach 241GW in 2021, an increase of 35.4% compared with 2020, and the global photovoltaic cell manufacturing capacity in 2021 will be about 441GW/year.

As of July 2022, spot prices for mono-crystalline PERC PV cells range from $0.155/W to $0.18/W, depending on wafer size, compared to $0.12/W to $0.14/W in January 2021. Its price level has reportedly remained stable since November 2021 and fluctuates based on demand. Silver prices have surged 22% in 2021, according to the Silver Institute, which is one reason for the rise in photovoltaic cell prices.

In 2021, China will produce about 198GW of photovoltaic cells, accounting for 82.2% of global cell production, an increase of 46.8% compared to 135 GW in 2021. Malaysia produced 13.1 GW, Vietnam 8.8 GW, South Korea 5.5 GW and Thailand 5GW.

“As Thailand and Vietnam are exempt from U.S. safeguard tariffs, production capacity in these countries is increasing,” the report said.

The report noted that Europe, the United States, India and Japan also reported PV cell production, but data from these countries was not mentioned in the report.

According to the report, the market share of PERC photovoltaic cells and TOPCon photovoltaic cells rose to 85% from 76% in 2020. Silicon heterojunction (STJ) photovoltaic cells and back-contact photovoltaic cells still maintain a market share of around 5%.

The global share of bifacial photovoltaic cells has reached 50% and is expected to exceed 60% by the end of 2022. One of the reasons for this growth is that bifacial PV cells are exempt from safeguard duties in the United States. In addition, the increasing production of single-axis trackers is also contributing to the market growth.

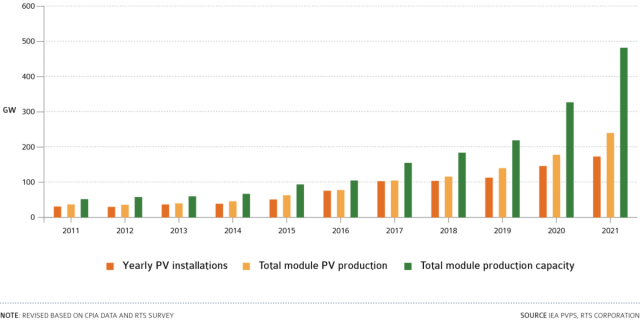

- Production of photovoltaic modules

Global PV module production will increase from 178.5GW in 2020 to 242GW in 2021. Rising polysilicon prices also boosted PV module prices. According to the report, in July 2022, the average spot price for a typical monocrystalline silicon PV module was US$0.256/W. In January 2021, the average price is $0.192/W, rising to $0.26/W in October 2021, and slightly decreasing to $0.247/W in December 2021.

Higher prices for glass and polymer materials have also reportedly impacted PV module prices, with glass prices up 18.2% in August 2021, ethylene, according to a September 2021 statement from China’s top five PV module manufacturers – Vinyl acetate resin (EVA) prices surged 35%.

According to the China Photovoltaic Industry Association, China produced 181.8GW of PV modules in 2021 and exported 98.5GW, a record high. The PV module production capacities of Vietnam, Malaysia, South Korea and the United States are 16.4GW, 9.1GW, 8GW and 6.6GW, respectively.

In 2021, the market share of crystalline silicon photovoltaic modules will account for 96.6% of the overall share, of which monocrystalline silicon photovoltaic modules will account for 88.9%. More than 80% of photovoltaic modules use crystalline silicon photovoltaic cells. Thin-film silicon PV modules will see a slight decline in market share in 2021, from 3.6% to 3.4%. The global production of thin-film photovoltaic modules is about 8.2GW, of which 7.9GW is produced by First Solar.

The report also includes the top five manufacturers of photovoltaic cells, modules and shipments in 2021.

If you are interested in full content of the report, welcome to comment here with email contact, so that I can share the report with you. Thank you for your reading today, and welcome to share your any ideas or questions in comment.