Recently, the Solar Energy Industries Association (SEIA) conducted a survey to measure the impact of the Commerce Department’s investigation of solar panels and modules imported from Southeast Asia.

Since the U.S. Department of Commerce announced an investigation into solar module imports from Cambodia, Malaysia, Thailand and Vietnam, the Solar Energy Industries Association (SEA) has organized an industry-wide survey that has received responses from more than 200 U.S. solar companies ranging from manufacturing dealers, installers to housing consultants.

Three-quarters of the 200 solar companies surveyed said three-quarters had delayed or canceled solar module deliveries to circumvent U.S. tariffs.

In March, the U.S. Commerce Department launched a nationwide investigation into crystalline silicon photovoltaic cells and modules produced in four Southeast Asian countries, based on a petition filed by U.S. solar developer Auxin Solar. The survey, conducted by SEA, focuses on U.S. solar companies that have suffered as a result of the Commerce Department’s investigation, which includes residential, commercial, community solar, and utility-scale solar sectors.

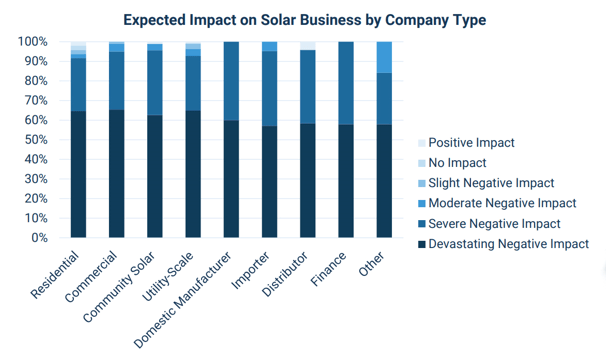

More than 90 percent of companies surveyed by SEIA reported a negative impact on their profits; two-thirds said at least half of the workforce had been laid off, and another third said, Their entire workforce is at risk, and all manufacturers who responded to the investigation said the case would have a disruptive or severe impact on their ability to operate.

The tariffs affected 84 percent of all U.S. solar modules imported from the four countries, as well as half of all cells imported for domestic module production, the survey showed. Companies surveyed expect the entire value chain to suffer, with 100% of domestic manufacturers in the survey expecting their operational capabilities to be disrupted or severely impacted.

The U.S. solar industry, already plagued by supply chain issues with trade and rising prices, is still years away from building a robust solar manufacturing supply chain to end its reliance on imports from these countries.

A third of projects were delayed by a quarter or more in the fourth quarter and 13% of projects in 2022 are expected to be delayed due to an 18% rise in solar equipment prices in 2021, according to a report released by SElA and Wood Mackenzie. , postponed for a year or more or canceled outright.

Another report by Wood Mackenzie estimated that circumvention applications could eliminate 16 gigawatts of PV modules from the US supply chain, accounting for two-thirds of all modules installed in 2021. SE1A estimates the petition could cost the solar industry 70,000 of its 230,000 jobs.

SEIA President and CEO Abigail Ross Hopper said the survey shows that the investigation is hitting the solar industry and undermining our efforts as a nation to combat climate change.