Thailand is an emerging PV market in Southeast Asia. The country is the second largest economy in Southeast Asia and is classified as a newly industrialized country: manufacturing, agriculture and tourism are its main economic sources.

According to data released by the World Bank (WB), the country’s GDP grew by 2.27% in 2019, and -6.09% in 2020 due to the impact of the global epidemic. The country’s economy will pick up in 2021, with a growth rate of 1.61%.

In 2022, the Thai authorities believe that the tourism industry in Thailand will gradually recover due to the effective global prevention and control of the epidemic. Coupled with its higher domestic consumption and investment demand, it is expected to achieve growth of 3.5%-4.5% in 2022.

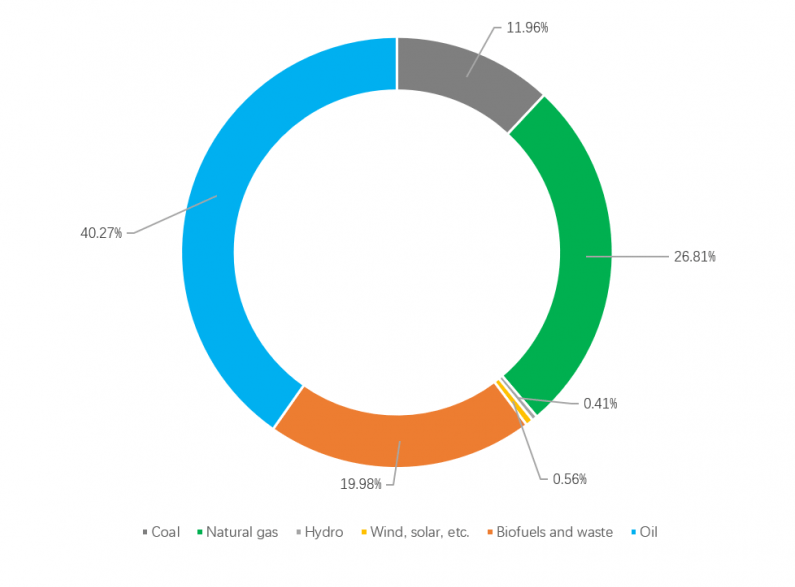

Thailand’s energy structure is mainly composed of three major fossil fuels, oil (40.27%), natural gas (26.81%) and coal (11.96%). The remaining 20.96% are bioenergy (19.98%) and renewable energy such as solar and wind energy (0.97%).

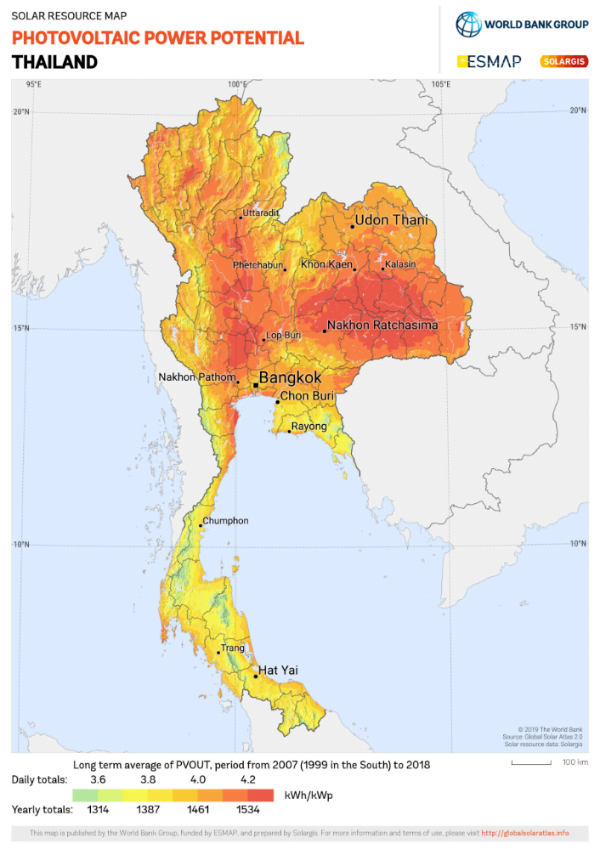

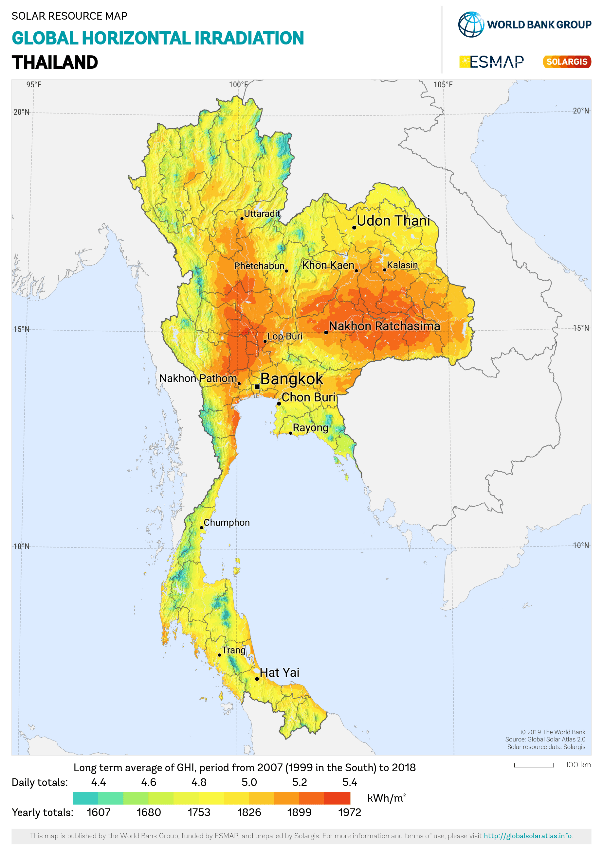

Thailand belongs to the tropical monsoon climate zone, with an annual radiation amount of about 1800kW h/m², and the radiation intensity is affected by the monsoon. About half of the country’s land area can reach 5.00–5.28kW·h/m² of radiation throughout the day, which is very suitable for the development of the photovoltaic industry.

The transformation process of Thailand’s electricity market from “fossil fuel dominated” to “diversified zero-carbon energy system” continues.

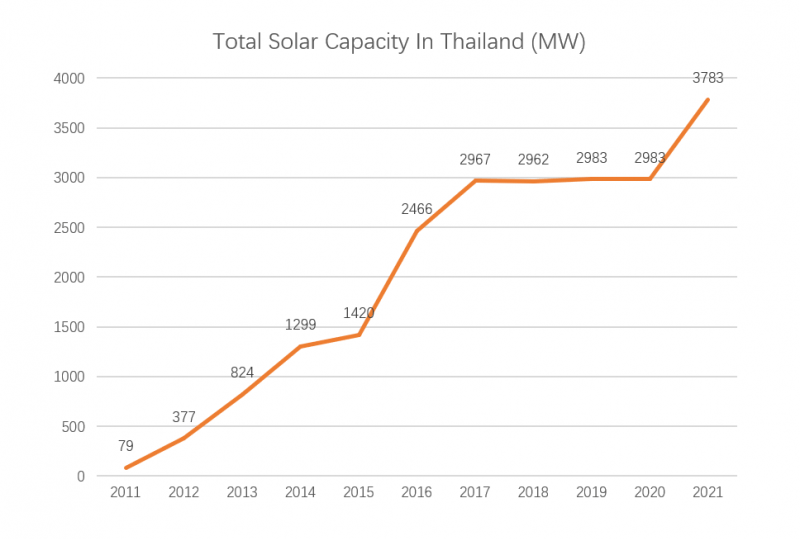

From 2011 to 2020, the installed capacity of renewable energy in Thailand has been on the rise. Among them, the installed capacity of photovoltaics has risen sharply in the early stage and flattened in the later stage.

In 2011, the installed capacity of photovoltaics was 79MW, and in 2015, the installed capacity was 1,420MW. In 2016, Thailand had the strongest growth in installed capacity, with an annual growth rate of 73%, reaching 2,466MW. In 2021, the newly installed capacity will be 800MW, and the cumulative installed capacity will reach 3,783MW.

According to Thailand’s National Power Development Plan (PDP), Thailand’s installed photovoltaic capacity is expected to reach 15.6GW by 2037.

In February of this year, CK Power, one of the largest renewable energy generators in Southeast Asia, announced plans to add 2.8GW of new renewable energy generation capacity in Thailand, and its installed capacity will double in the next three years, of which photovoltaic power generation capacity will increase by ten times, reaching more than 330MW.

In addition, the Thai government also encourages the development of photovoltaic floating body projects. In the next 16 years, the country will build 8 floating solar power stations one after another, and the total power generation is expected to reach 2725MW.

At the beginning of 2020, the Electric Power Authority of Thailand (EGAT), China Energy Construction Shanxi Research Institute and Thailand B.GRIMM Co., Ltd. jointly contracted the photovoltaic floating body project of the Sirindhorn Dam (Sirindhorn Dam), with a transaction value of 160 million yuan.

The project was put into operation last October, with 144,420 photovoltaic panels covering 720,000 square meters of water, an area equivalent to 50 football fields, and generating 45MW of electricity, making it the world’s largest photovoltaic floating project. The project will help lift the time-of-use restrictions on renewable energy. Photovoltaic power generation is used during the day, and hydropower is used at night. On the one hand, the existing resources of the dam are fully utilized, and on the other hand, the cost of electricity is reduced.

At present, 7 sets of photovoltaic panels and buoys have been installed in the Sirindhorn Dam, with a total of 144,420 photovoltaic modules installed. After the project is put into operation, it can reduce carbon dioxide emissions by 47,000 tons per year.

EGAT plans to advance 15 more projects nationwide, totaling 2,725MW, to drive Thailand steadily towards a sustainable low-carbon society and become a leader in clean energy.

Thailand is also the country with the largest installed wind energy capacity in Southeast Asia.

As of 2021, Thailand’s installed wind energy capacity has reached 1.554GW, and during 2022-2025, the Thai wind energy market is expected to grow at an annual growth rate of more than 5%, and the installed capacity will reach 7GW.

Due to the growing energy demand in Thailand and the increasing share of renewable energy in the power sector, Thailand’s energy sector is working to reduce its reliance on fossil fuel power generation and introduce regulations related to energy efficiency. Research shows that the potential wind energy development in Thailand with an average annual wind speed of 6m/s is about 14GW. The central region of the country has the greatest potential for wind energy development, up to 5GW.

However, Thailand’s current wind power development still faces a series of challenges such as resources, technology and land. A number of policy and regulatory headwinds will also dampen the growth of the Thai wind energy market in the coming years.

Thailand aims to increase wind energy to 3,002 MW by 2036, up from about 1.6 GW in 2021. Raising the country’s wind energy target to 7 GW by 2037 and developing a corresponding policy framework will ensure that wind energy projects can be effectively developed, as Thailand is moving towards clean and competitive energy.

Upcoming projects in the Gulf of Thailand offshore wind energy market are expected to create significant opportunities for players involved in the wind energy market in the near future.

In mid-July last year, Thai renewable energy company BCPG received a $652 million loan from the Asian Development Bank (ADB) to build Southeast Asia’s largest wind farm in neighboring Laos. The wind farm is expected to have an installed capacity of 600 MW.

With the help of Thailand, the Lao People’s Democratic Republic has also expanded into other forms of renewable energy over the past few years. Thailand is a leader in wind and solar power generation in Southeast Asia, which creates a natural potential partnership.

The Thai government has formulated a series of plans for energy development from 2015 to 2036. Among them, the National Renewable Energy Development Plan (AEDP) and the 2015-2036 Thailand Power Development Plan (PDP) both encourage the use of solar energy, Renewable energy such as biomass and wind power. In 2019, the Thai government released the revised Electric Power Development Plan (2018-2037), which proposed to increase the proportion of renewable energy power generation to 30% by 2037.

It is worth mentioning that the National Renewable Energy Development Plan (AEDP) prioritizes waste, biomass and biogas as development projects, and photovoltaic and wind power will be promoted to renewable energy projects that are comparable to natural gas development. The policy target is 19.635GW of renewable energy installed capacity in 2036.

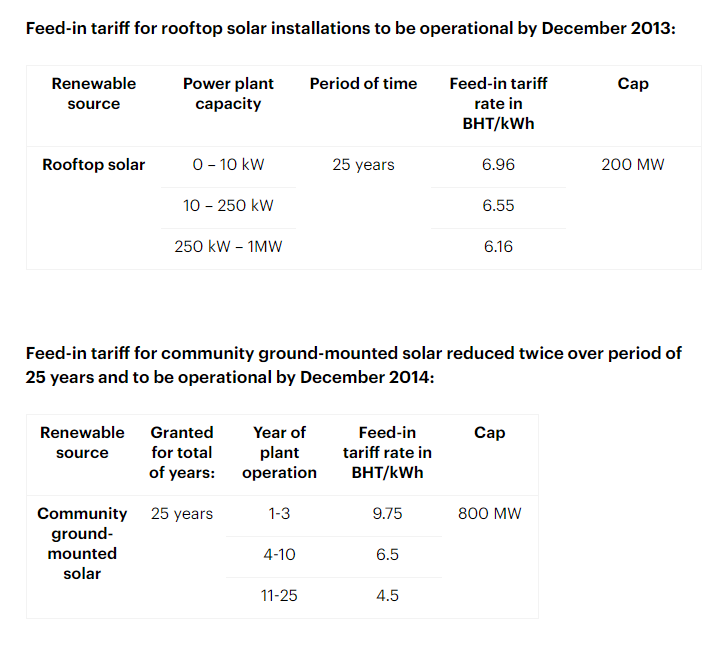

The obvious dependence on fossil fuels has led to the slow pace of sustainable green economy development in Thailand. The Thai government began to introduce a series of policies to promote the production of renewable energy in 2007, including changing the vehicle tax collection structure to promote energy conservation and emission reduction, and introducing the FIT system. Stimulate photovoltaic installations, etc.